The Future of Central Bank-Backed Digital Currencies

The Future of Central Bank-Backed Digital Currencies

Introduction

Central bank-backed digital currencies (CBDCs) have been a hot topic of discussion in the financial world lately. With the rise of cryptocurrencies like Bitcoin, central banks around the world are exploring the idea of launching their own digital currencies. In this blog post, we will explore the future prospects of CBDCs and their potential impact on the financial landscape.

What are Central Bank-Backed Digital Currencies?

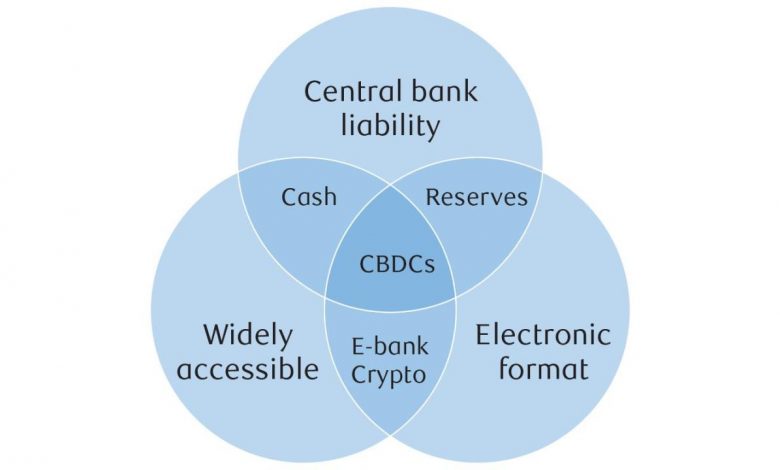

CBDCs are digital forms of fiat currency that are issued and regulated by central banks. Unlike cryptocurrencies, CBDCs are not decentralized but rather controlled by central authorities. These digital currencies are designed to offer the convenience and security of digital payments while maintaining the stability and trust associated with traditional fiat currencies.

Potential Benefits of CBDCs

– Increased Financial Inclusion: CBDCs can provide access to financial services for the unbanked and underbanked populations, enabling them to participate in the digital economy.

– Enhanced Security: With the use of blockchain or other advanced technologies, CBDCs can provide a secure and transparent payment system, reducing the risk of fraud and counterfeiting.

– Improved Monetary Policy: CBDCs can allow central banks to have a direct influence on the money supply and circulation, leading to more effective monetary policy implementation.

Challenges and Concerns

– Privacy and Surveillance: With the implementation of CBDCs, concerns arise regarding the potential invasion of privacy and increased surveillance by central authorities. Striking a balance between privacy and regulation is crucial.

– Cybersecurity Risks: Digital currencies are susceptible to cyber-attacks. Central banks must invest in robust cybersecurity infrastructure to prevent unauthorized access and protect against financial risks.

– Mitigating Monetary Disruption: Introducing CBDCs could disrupt the existing financial ecosystem. Central banks need to carefully manage the transition to minimize disruption and ensure a smooth integration into the financial system.

Frequently Asked Questions (FAQs)

Q1: Will CBDCs replace cash?

A1: While CBDCs have the potential to reduce the demand for physical cash, it is unlikely that they will completely replace it. Central banks are exploring a hybrid model where both forms of currency can coexist.

Q2: How will CBDCs be distributed?

A2: Central banks are considering various methods of distribution, including direct issuance to individuals or through intermediaries such as commercial banks. The goal is to ensure accessibility and ease of use for everyone.

Q3: Can CBDCs replace cryptocurrencies?

A3: CBDCs and cryptocurrencies serve different purposes. CBDCs are controlled by central authorities and focus on stability and regulatory compliance, whereas cryptocurrencies are decentralized and known for their anonymity and speculative nature.

Conclusion

The future of central bank-backed digital currencies looks promising. CBDCs have the potential to revolutionize the financial landscape, offering increased financial inclusion, enhanced security, and improved monetary policy. However, challenges regarding privacy, cybersecurity, and the transition process need to be carefully addressed. As central banks continue to explore CBDCs, the financial world eagerly awaits their implementation and the transformative impact they may bring.